In the last few months we’ve seen more and more people falling victim to a range of investment scams on social media.

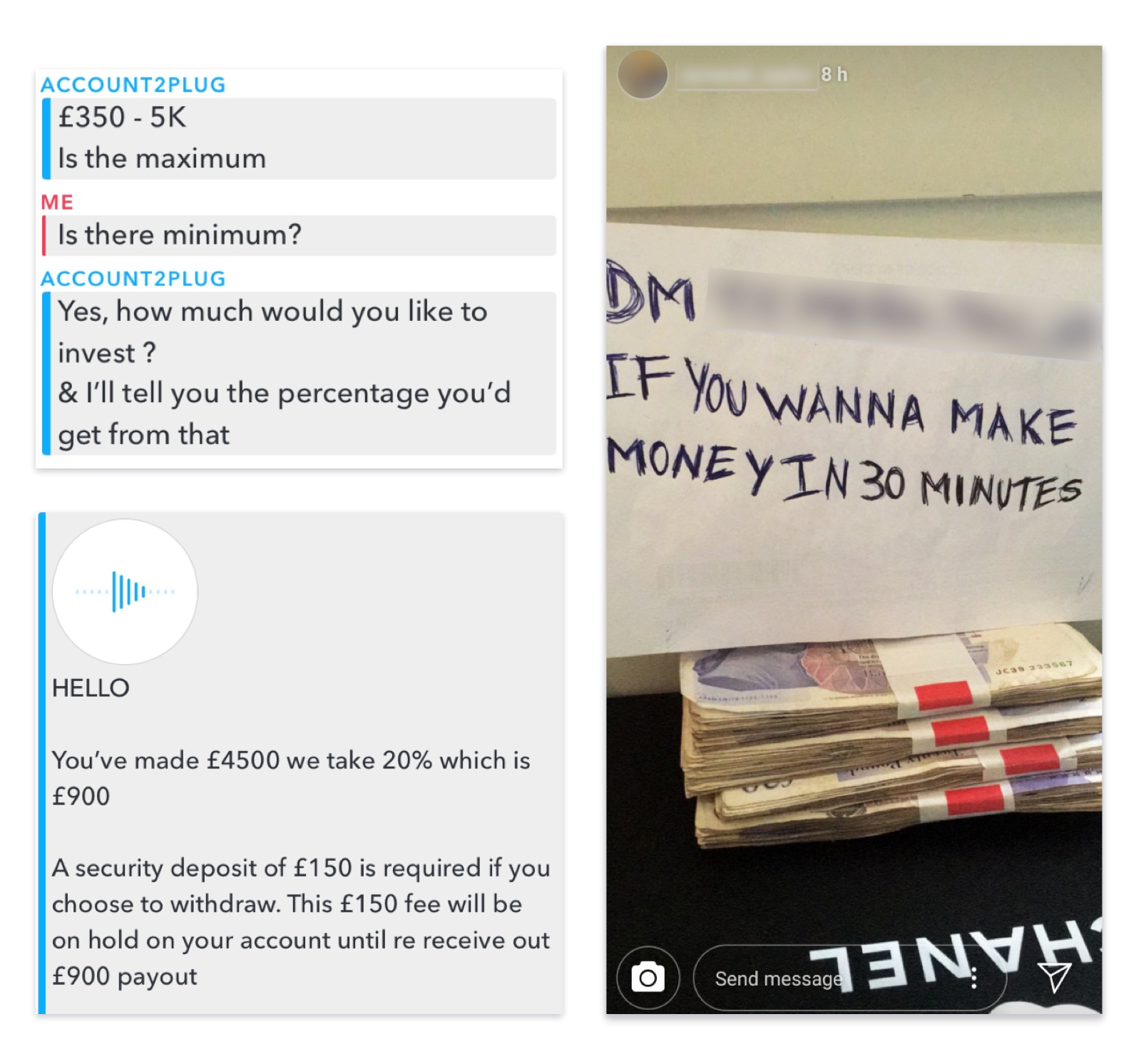

Fraudsters have been approaching people on Snapchat and Instagram, encouraging them to invest their money by promising very high returns. But the people who’ve fallen for these scams end up losing everything they’ve invested.

Last month, you reported seeing or falling victim to these kinds of scams 19 times (up from five in the previous month), losing more than £15,000 to fraudsters. We’re seeing these scams affect some of our younger customers – the average age of victims in June was 19.

How the scams we’re seeing work

Fraudsters will approach you on Snapchat and Instagram, or run ads on these sites. They’ll offer to invest money on your behalf and promise huge profits, quickly. Some scams we’ve seen say they can guarantee a return of as much as 400% in a matter of days.

They’ll suggest how much money you should invest at the start, usually between £100 - £200. And once you invest, they’ll sometimes move your communications onto WhatsApp instead.

These ‘investors’ usually don’t go into detail about what you’d be investing in. They just promise they can make you lots of money, very fast.

But in reality, your money isn’t really being traded or invested, and you’ll probably lose it all.

You’re even at risk of being defrauded for a second time, if the fraudster asks you to pay a fee to get the profits you’ve made on your investments.

If you get suspicious and start asking questions, they’ll often block you immediately, leaving you with no idea who they are and no way of getting your money back.

The people we’ve spoken to have rarely known the full name of the person they’re talking to, or even if they are who they say they are.

They’ve also told us they assumed the investor was legitimate because they had lots of followers on Instagram, posted images with lots of cash or luxury items, and had lots of glowing reviews from satisfied customers. But in reality, these things are red flags and legitimate investors won’t usually do this.

How to protect yourself from investment scams

1. Be wary if you’re approached by an investor, or see adverts on social media

Authorised investment firms and reputable brokers won’t conduct business on social media.

2. Do your research before investing

If you’re considering making an investment, check if the firm is authorised by the FCA and use their Warning List on potential investment opportunities.

Understand exactly what they’ll invest your money in. And if it’s not clear, don’t invest.

3. Think carefully before sending any money

Fraudsters will often try to pressure you into sending money by saying you'll miss out on massive profits unless you send the money straight away.

Once you send money, it’s very difficult to get any of it back. If you invest in an unauthorised firm, you won’t have access to the Financial Ombudsman Service or Financial Services Compensation Scheme (FSCS).

4. Be suspicious if an investor promises you guaranteed profits

All legitimate investments carry risk, and there’s a chance you won’t get back the money you invested.

But fraudsters claim profits are guaranteed and that the investment is fool-proof. Be very wary of investors making claims like this, it’s likely that the investment opportunity is a scam.

5. If it sounds too good to be true, it probably is!

If someone is promising you thousands of pounds in return for a small upfront fee in a matter of hours or days, it’s unlikely to be a genuine investment opportunity.

You’d be doing very well if you saw 4-5% return on an investment. So if someone’s promising you 400-500%, it’s highly likely they are trying to scam you.

What to do if you’ve been a victim of an investment scam

Report it to your bank as soon as possible. Your bank will reach out to the bank where you sent the money to see if it’s still in the account.

Report what happened to Action Fraud.

If you’ve been scammed by a firm (as opposed to a person on social media) you can also report what happened to the FCA.

Check out this post from Action Fraud for more information about these kinds of scams.