Monzo is more than just a bright pink bank card! It can help you budget, save, split bills with your friends and lots of other things that’ll make your life a lot easier.

So, we’ve put together some tips to help you get the most out of your Monzo account.

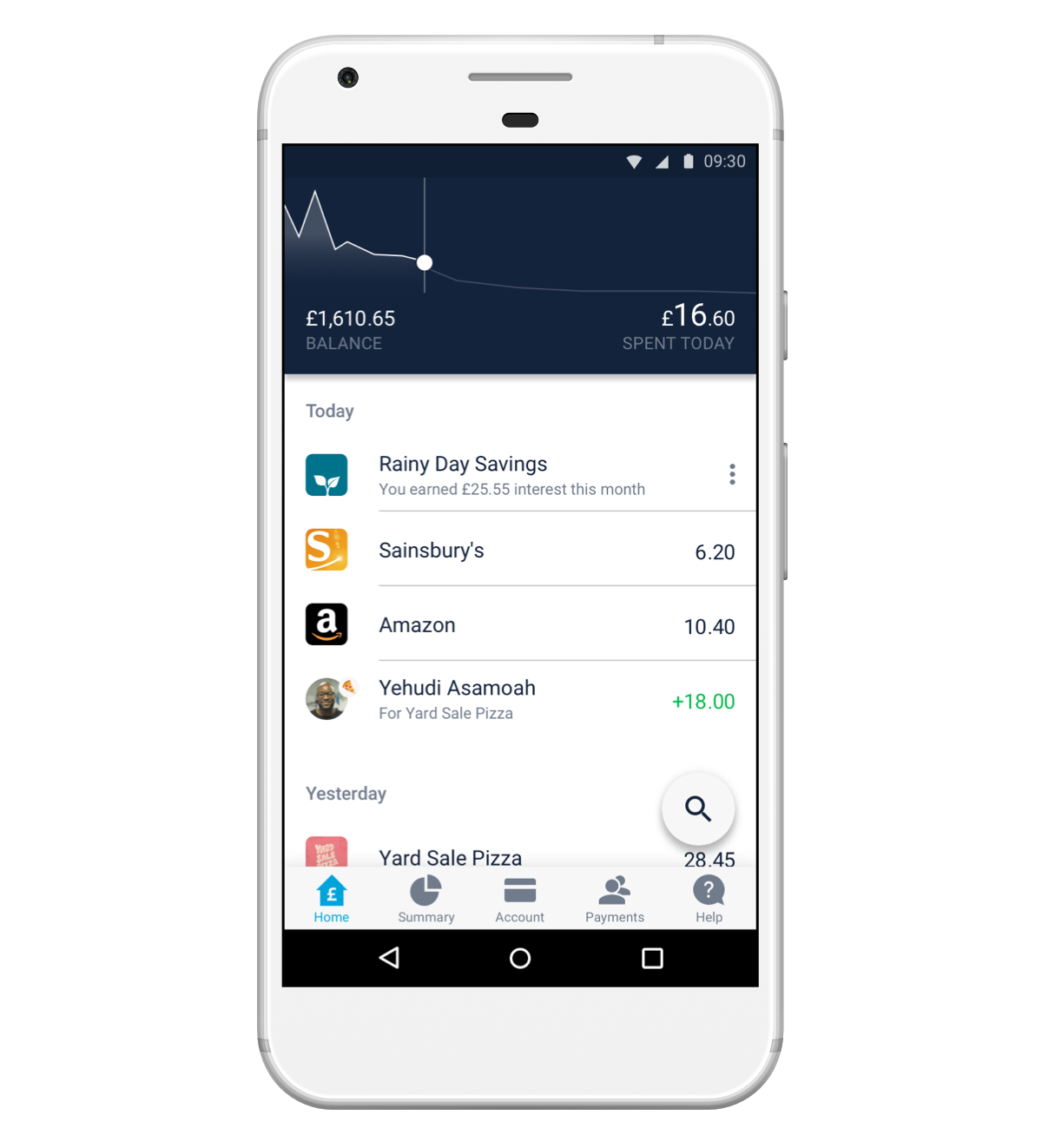

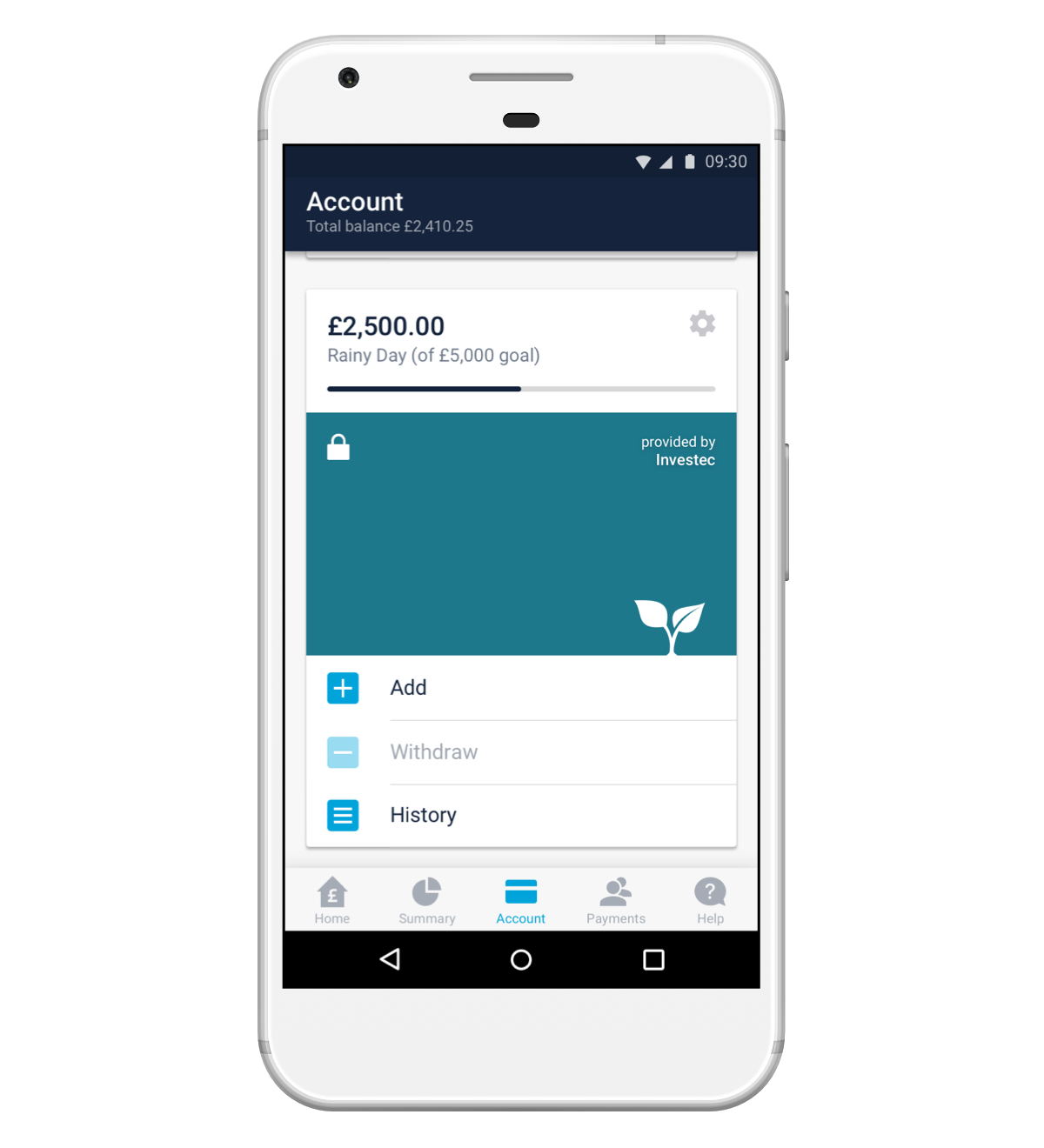

1. Earn interest on your savings by opening a Savings Pot

Savings Pots let you earn up to 1.63% AER interest on your money. And you can open one in seconds and manage everything through Monzo.

See all the savings accounts and interest rates we offer. And to open a Savings Pot, just tap the button below on your phone!

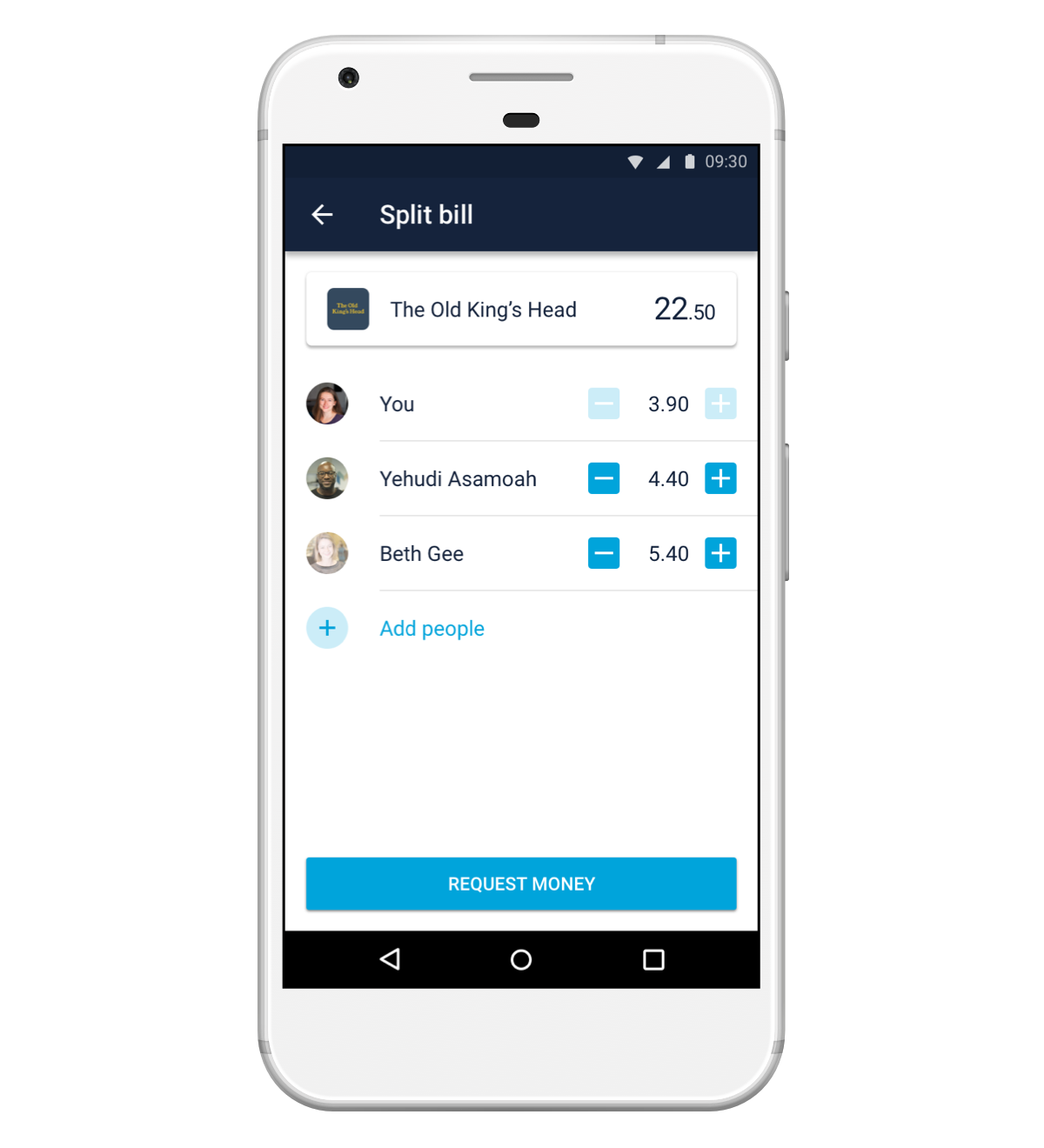

2. Pay friends and split bills super easily (especially when your friends are on Monzo)

Monzo makes it easy to pay and get paid by your friends (especially if they have Monzo too).

Invite your friends to Monzo! Head to the Payments tab in your app to invite friends.

And if they need some persuading, here are 12 things you should say to your friends to convince them to get Monzo.

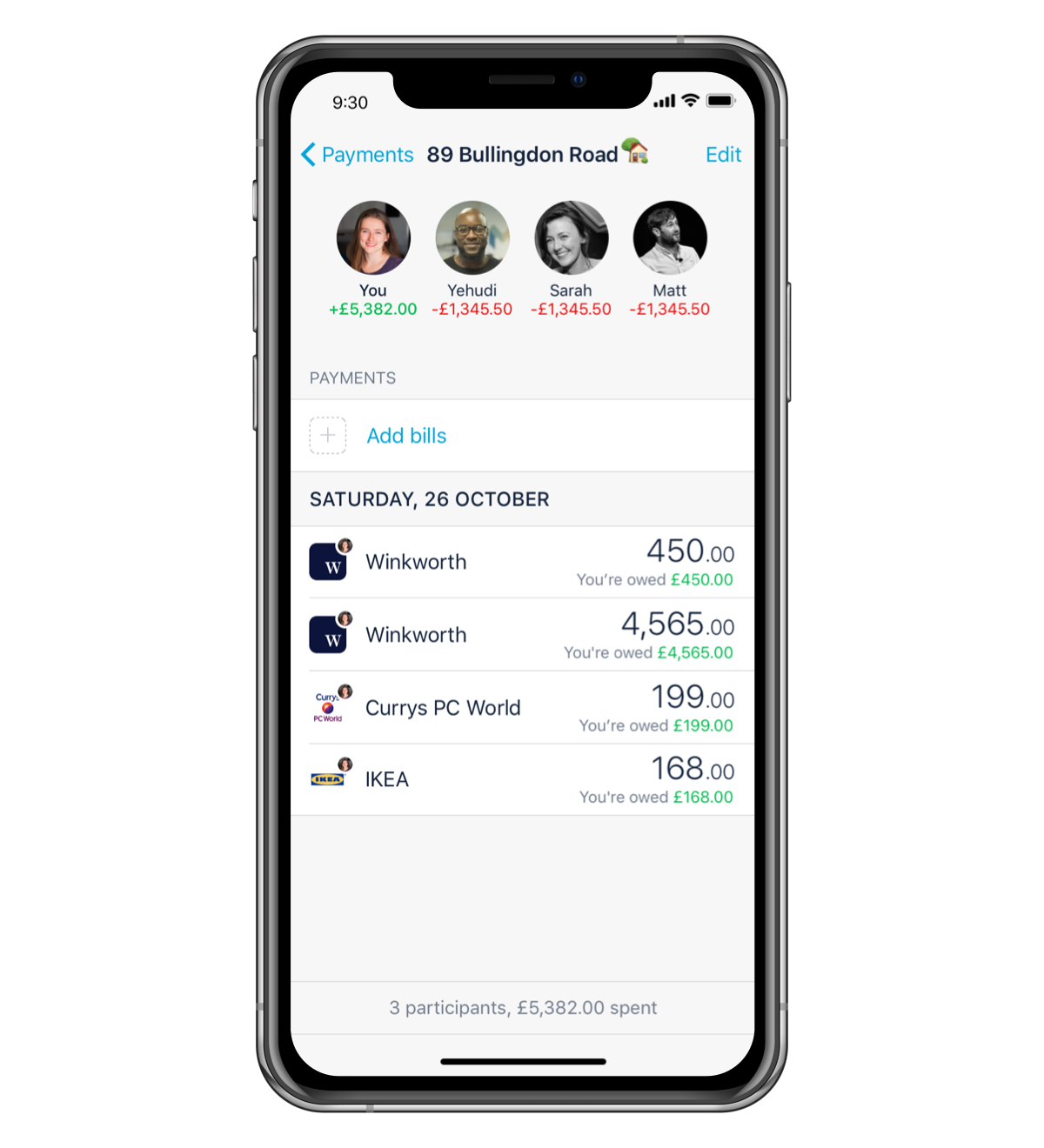

3. Use Shared Tabs to actually keep track of who owes you money

Settling up a bunch of bills can be a pain. Everyone pays from their own account, and then when it’s time to settle up you have to do the dance of the bank details.

So why not use Shared Tabs instead? They make it easier to keep track of who owes what, whether you’re going on a group holiday or splitting household bills with your flatmates.

You can settle individual bills as you go, or keep the Tab running for as long as you need. And you can split bills evenly or change the amounts so they match how much you’ve paid.

Just head to the Payments tab in your app to start a Shared Tab.

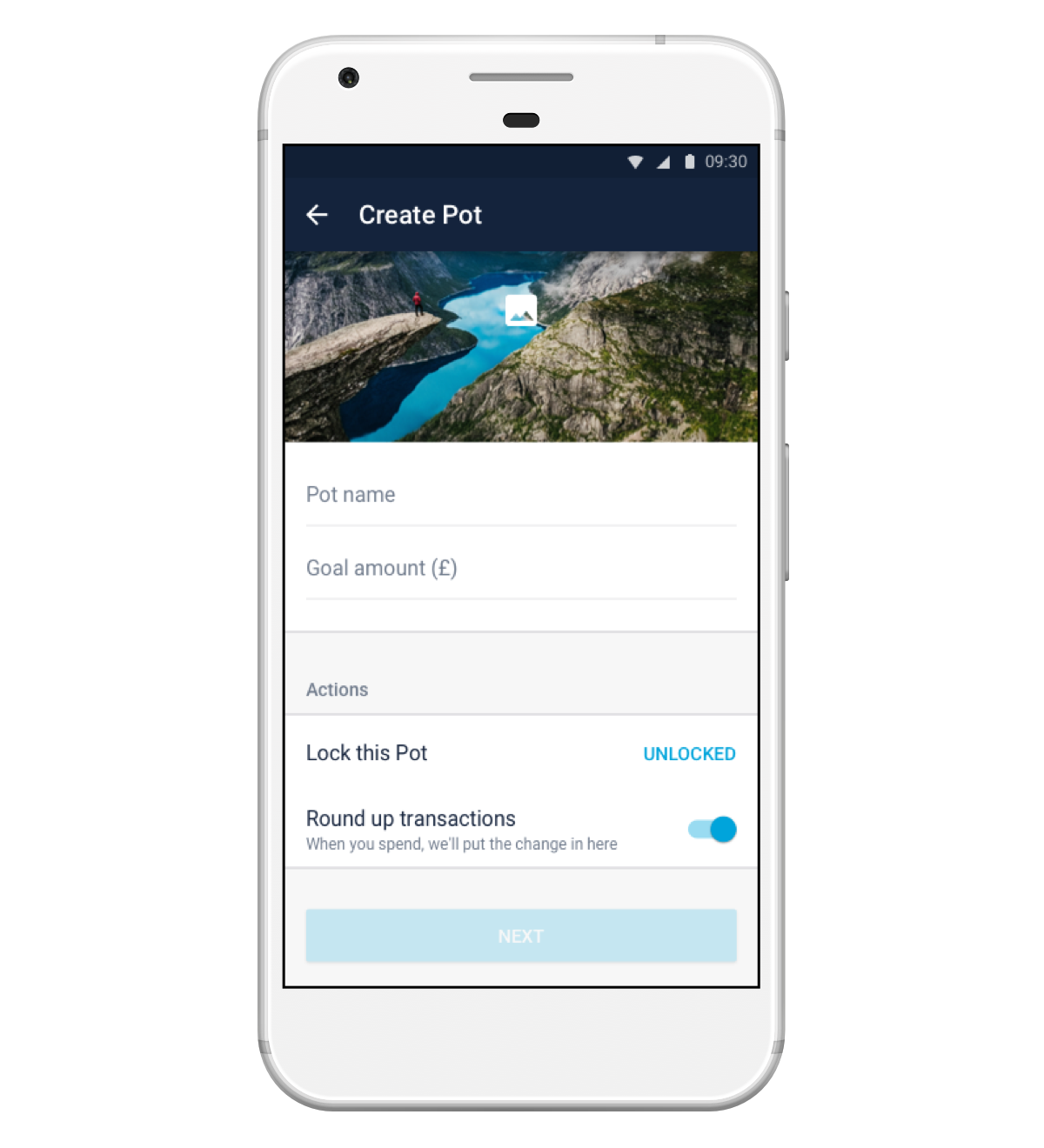

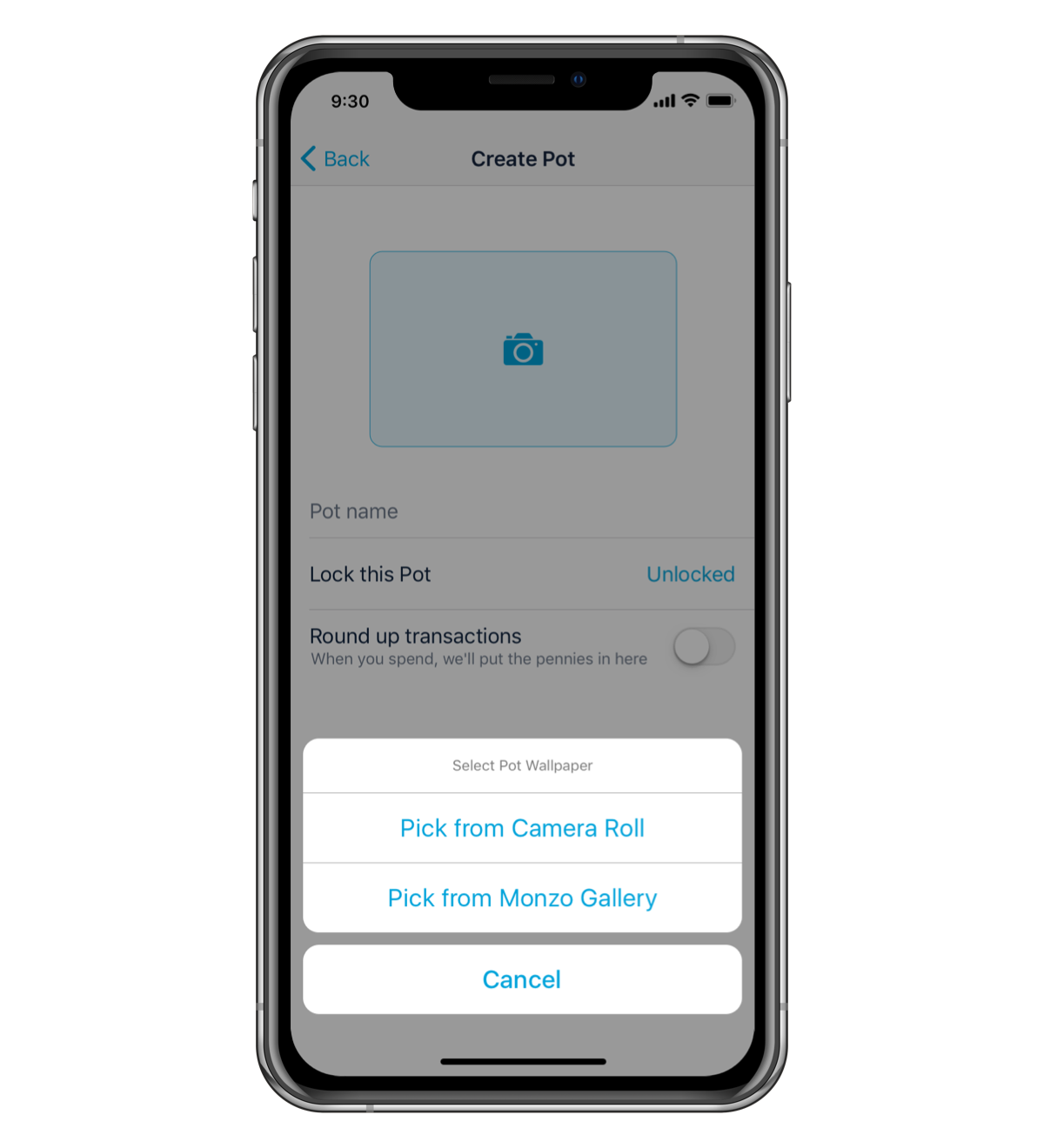

4. Save your spare change automatically

You can use Monzo to save as you spend, to help you set some extra cash aside.

We’ll round up your purchases to the nearest pound and put the spare change in a Pot.

Just create a new Pot (or edit an existing one) and you’ll see the option to switch on round-ups.

Whenever you buy something that costs more than £1 and you’re not in your overdraft, we’ll round up the purchase and put the spare change in a Pot of your choice.

5. To stop you dipping into your savings, lock your Pots

It can be tempting to dip into your savings, especially when it only takes a few taps. So to help you stick to your savings goals, lock your Pots until a date you choose.

If you try to take money out of a locked Pot, we’ll remind you that you can’t until the date you set.

By adding some extra friction, we hope you’ll find it easier to control your spending or save towards your goals.

6. Get creative and add any image you like to your Pots

Maybe you’re super organised and want everything to look pretty. Maybe you need inspiration to stick to your savings goals.

However you save, you can add your own images to your Pots.

You’ll see the option to pick an image when you make a new Pot (or edit an existing one). Here’s a rundown of some of the best Pots we’ve seen so far.

7. Pick your own app icon

Head to your settings to find the option to pick a different icon for the Monzo app.

Just look for ‘Custom app icon’ and pick your favourite!

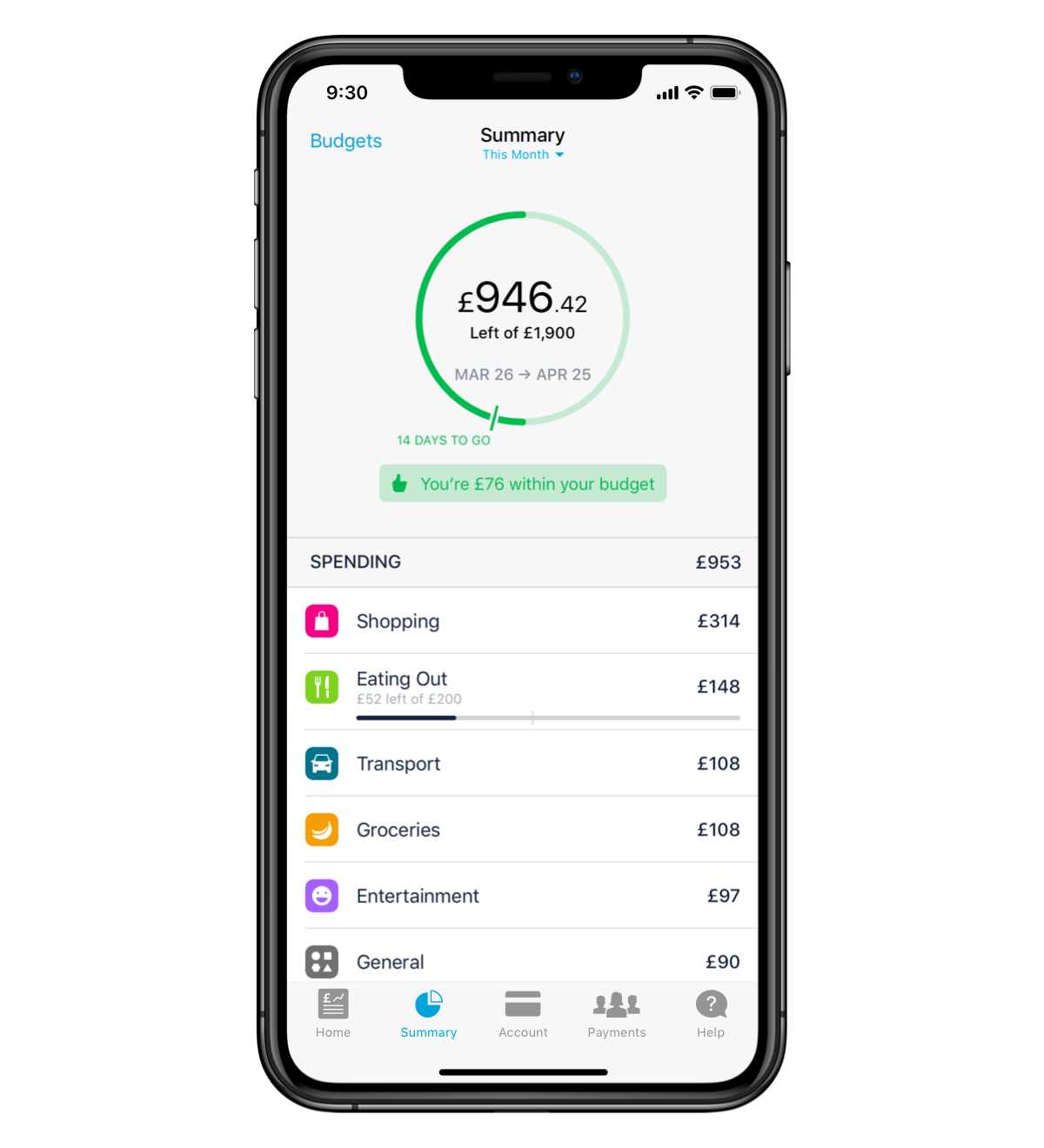

8. Set budgets to track your spending (and keep it in check)

If you’re saving up towards a goal or trying to get your spending under control – you can use Monzo to set budgets and track your progress every month.

We automatically put all your spending into categories like groceries, bills or eating out, and you can set budgets for each one. We’ll tell you whether or not you’re on track.

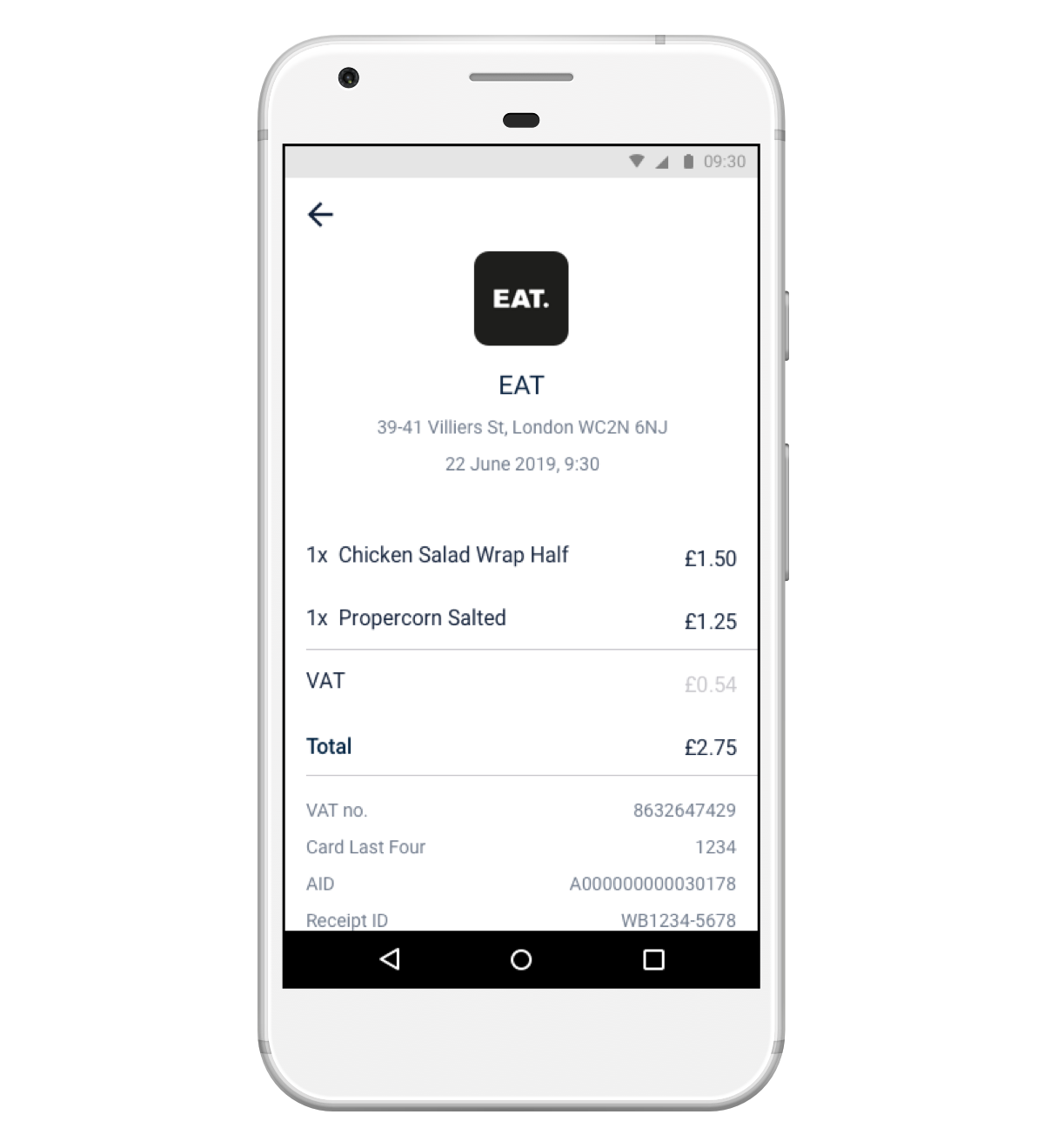

9. See exactly what you’ve bought and get rid of paper receipts

We’ve teamed up with a company called Flux so you can see receipts in your Monzo app when you shop at different places.

Right now, this works when you shop at EAT., Itsu, Pure, Pod and – crucially – KFC.

Just visit one of these shops and make a purchase with your Monzo card. When you tap on the transaction, you'll see the option to connect your account to Flux.

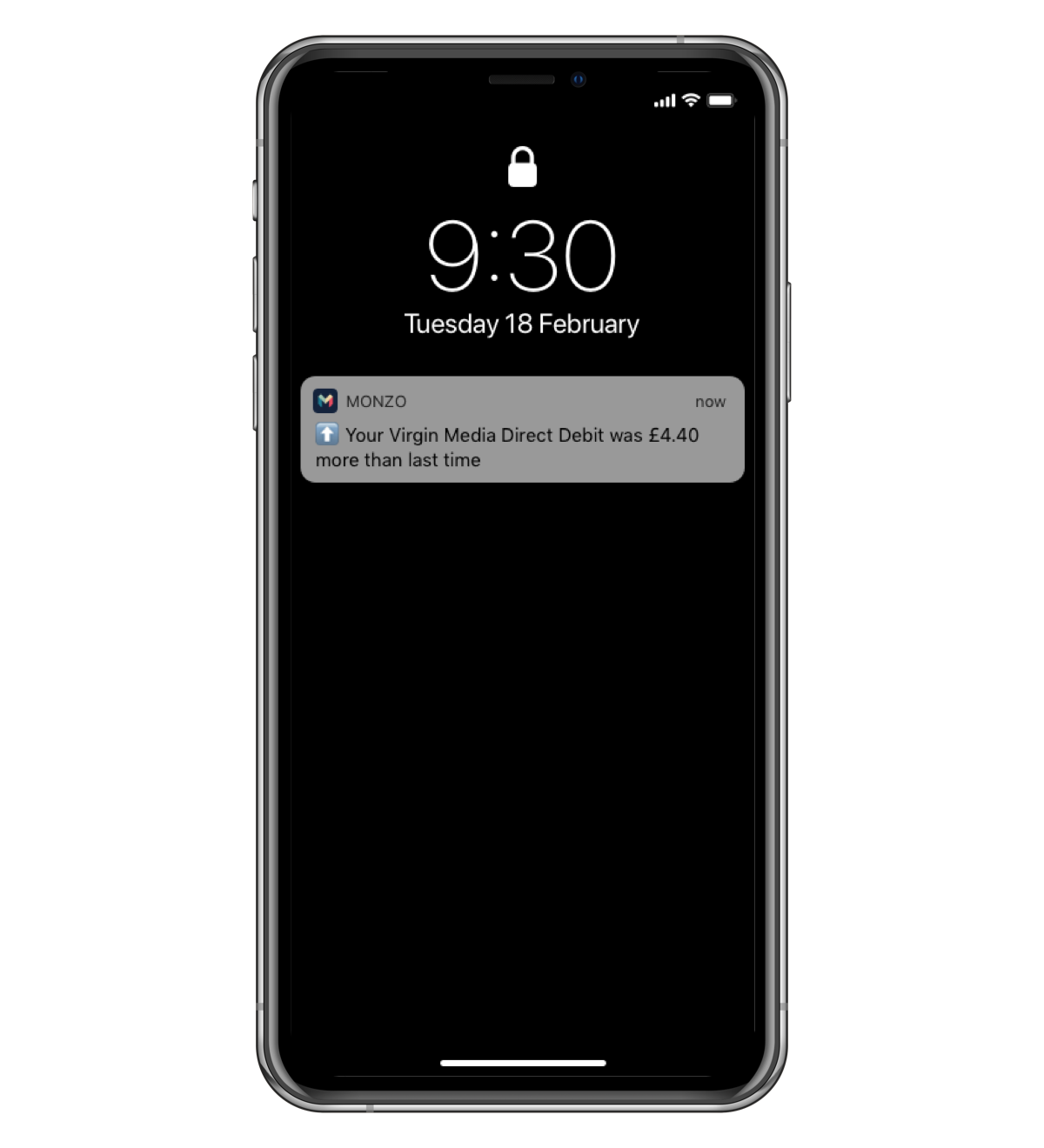

10. If you pay your bills through Monzo, we’ll give you a heads up if they increase

We’ll keep track of your regular Direct Debits – like phone contracts and utility bills – and let you know if one of them changes.

So if your energy provider raises their prices, or you rack up a big phone bill while you’re away, you’ll immediately know how much it’ll cost you, as soon as the money goes out of your account.

The Current Account Switch Service makes it easy for you to switch all your bills and other payments to Monzo (and close your old bank account). Find out more.

11. See into the future (and avoid any nasty surprises)

If there’s an upcoming payment and you don’t have enough in your account to cover it, we’ll give you a heads up the day before, to give you time to add money into your account if you can.

We also show you tomorrow’s upcoming payments at the top of your transaction feed. So you always know what’s coming in and out and can avoid any unwelcome surprises.

You can see Direct Debits and Direct Credits, standing orders, scheduled bank transfers, any overdraft fees or loan repayments, and scheduled payments into and out of Pots.

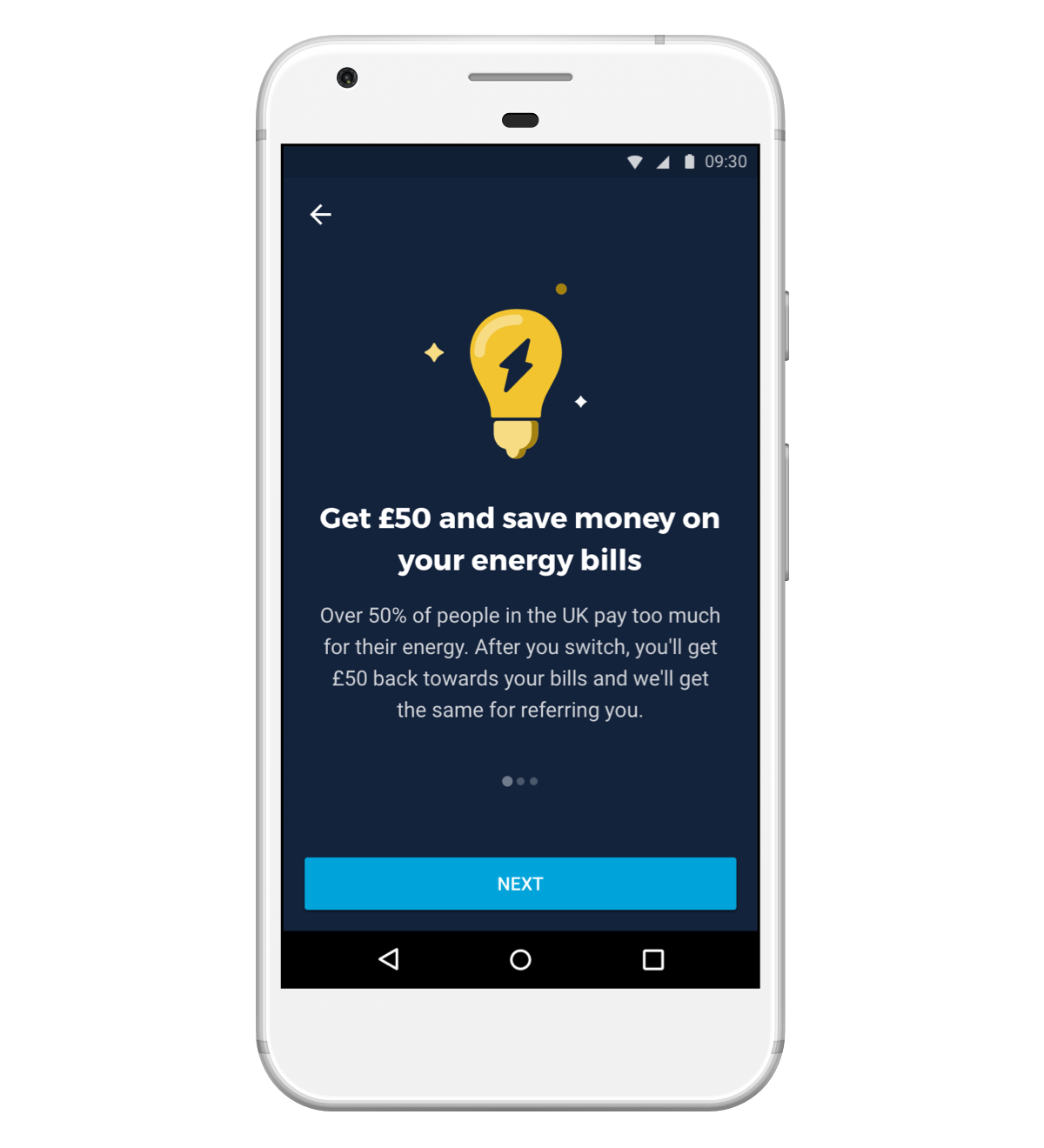

12. Save money on your bills by switching energy supplier

If you haven’t renewed your contract with your existing energy supplier or switched to a new one in the last few years, you could be paying more than you need to for your energy.

Your energy supplier usually puts you on a more expensive default tariff once your original contract ends. According to the energy regulator Ofgem, more than half of people in the UK are on these expensive ‘standard variable’ tariffs.

That’s why we’ve made it easy to switch energy supplier through Monzo!

Find out how it works and how to get started – or tap the button below on your phone.

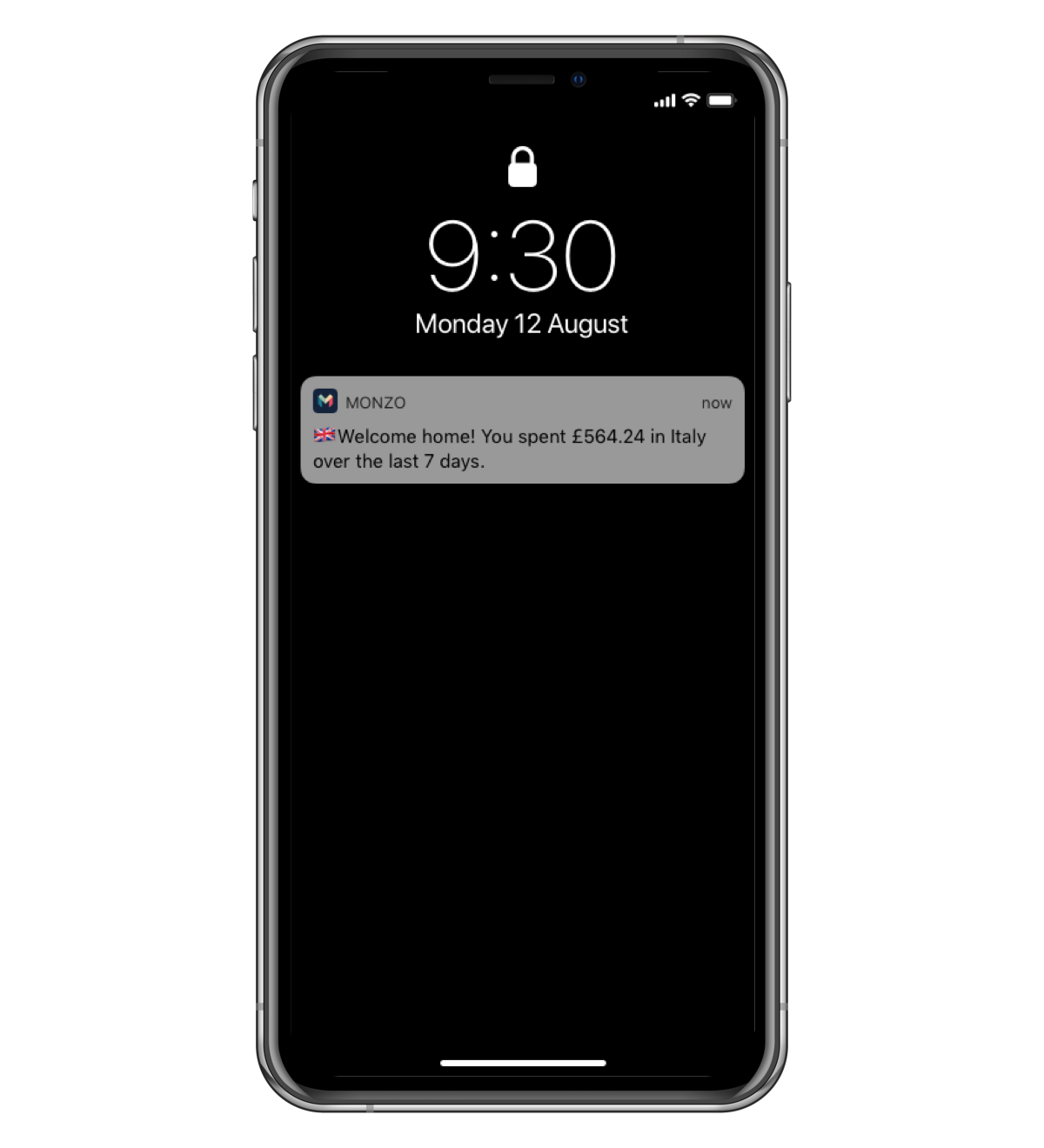

13. Take Monzo on holiday to avoid fees and markups when you spend abroad

Use your Monzo card to pay in shops, restaurants and online, anywhere in the world and in any currency, with no fees.

When you spend with your Monzo card, we pass Mastercard's exchange rate directly on to you, and don't add fees or extra charges.

If you want to withdraw cash when you’re abroad, you can take out £200 for free every 30 days. After that, we’ll charge you 3%.

Remember, always choose to pay in the local currency. If you choose to pay in pounds, the shop or cash machine will convert your money at their own exchange rate, which can end up costing you more.

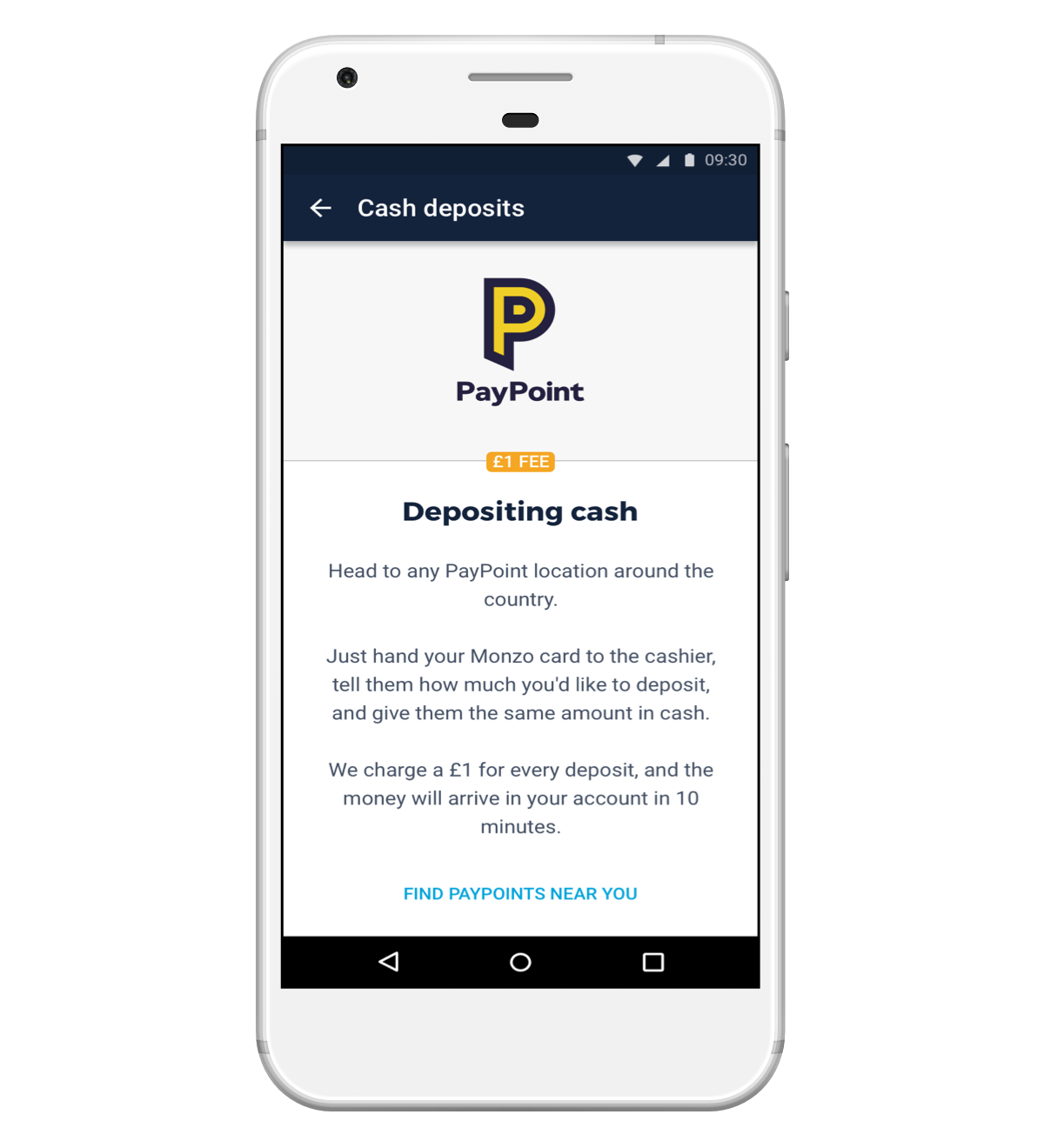

14. Pay cash and cheques into your account

Even though Monzo lives on your phone, you can still pay cash and deposit cheques into your Monzo account.

To deposit a cheque, just write your account number on the back and post it to us for free.

And to pay in cash, just head to one of the 28,000 stores around the UK that show the PayPoint logo. We’ll charge you £1 for each deposit you make, and you can pay between £5-300 in in one go.

Have we missed anything? Share your tips and tricks for getting the most out of Monzo in our community!