As the cost of living crisis continues, people are turning to tried and tested ways of saving money – and many of them involve using good old-fashioned notes and coins.

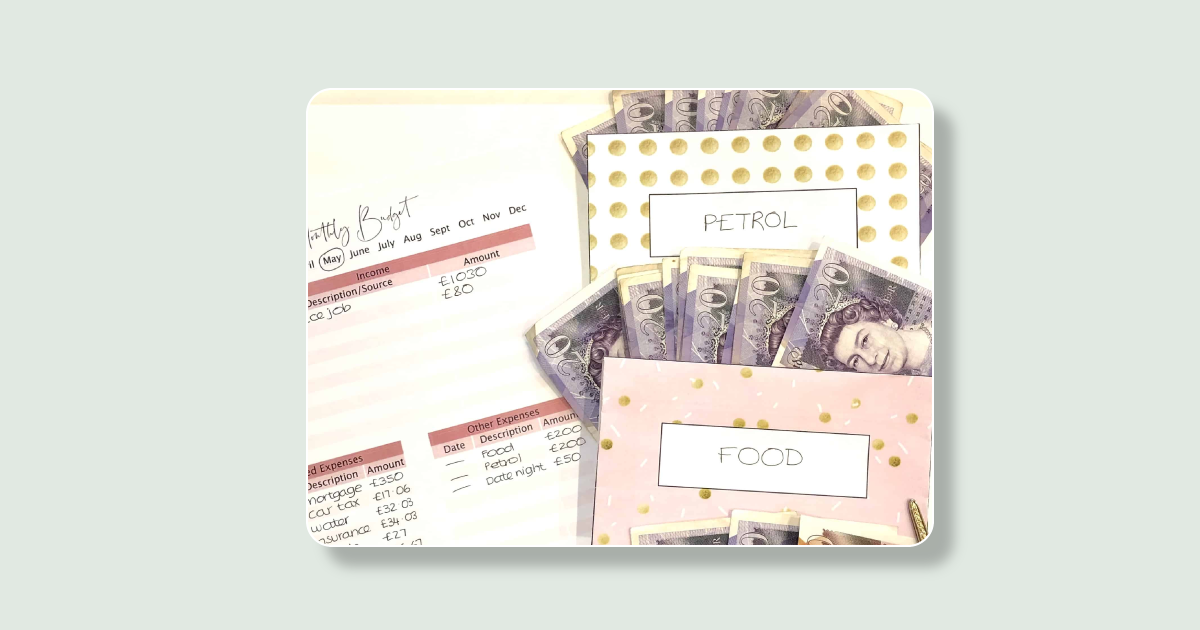

Take cash stuffing, for example. This saving tactic involves earmarking a bunch of envelopes for different categories of spending – rent, food, bills etc – and literally stuffing the money allocated for each one into them.

It’s a simple way of budgeting by setting limits on your spending. And the trend is going viral. The hashtag #cashstuffing has clocked up 670 million views on TikTok. And in the 12 months leading up to this September, online searches for ‘cash stuffing’ shot up by 503% compared with the previous year.

Tactics like these are great for feeling more in control of your money. And when you have Monzo, you can carry out the same saving strategies in the app. That way, you can stay on top of your money without actually having to go to a cash machine. Let’s take a look at how it works…

Skip envelopes, try Pots

Pots are a paperless way of trying cash stuffing – and you can do it straight from the Monzo app. When you create a Pot with Monzo, you’re setting money aside from your main bank balance for a specific purpose. This could be rent, food or bills (as we mentioned above), but it could also be ‘Gary’s birthday’ or ‘takeaways’ or ‘self-care’.

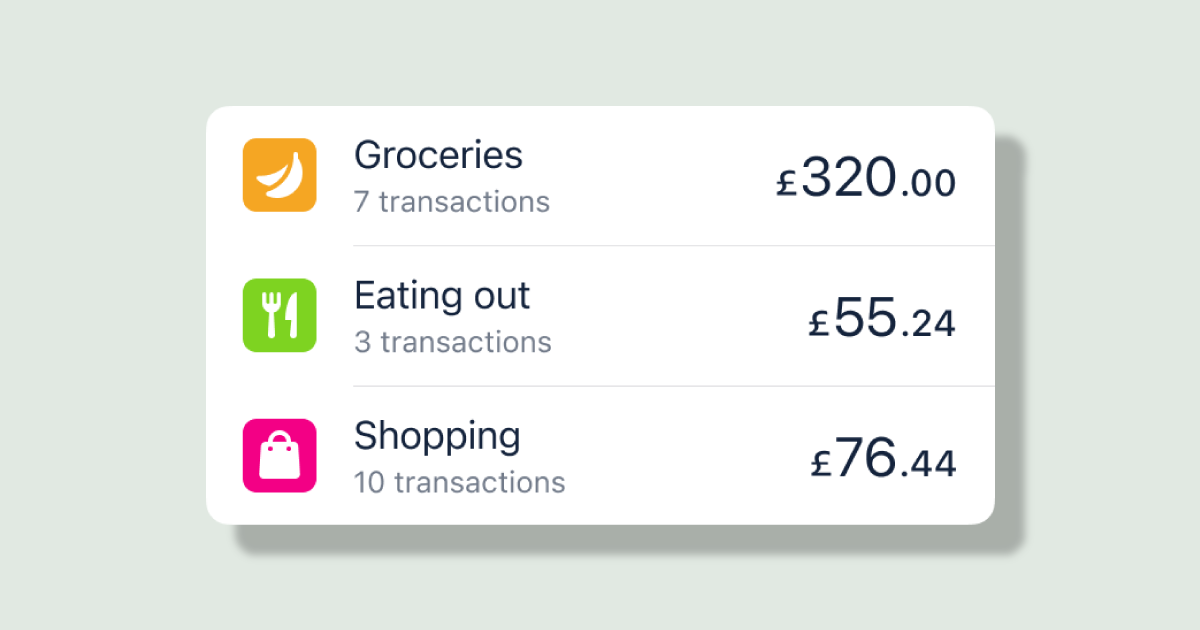

You can create a Pot for anything you like. If you want to know what you tend to spend money on, Monzo categorises your spending automatically so you can always take a look back and plan your Pots accordingly.

Fill each Pot with the amount you want to spend. And when that Pot runs out, you know not to spend any more money on it.

Personalise your Pots

You can give your Pots any name you choose and add photos to bring them to life. If you’re putting money aside for something fun or saving up for something special, giving your Pots a photo can remind you what you have to look forward to and help you stay motivated.

And if you’re worried that you might dip into your Pot early, you can hide them and lock them to remove the temptation.

Sort your money in a few taps

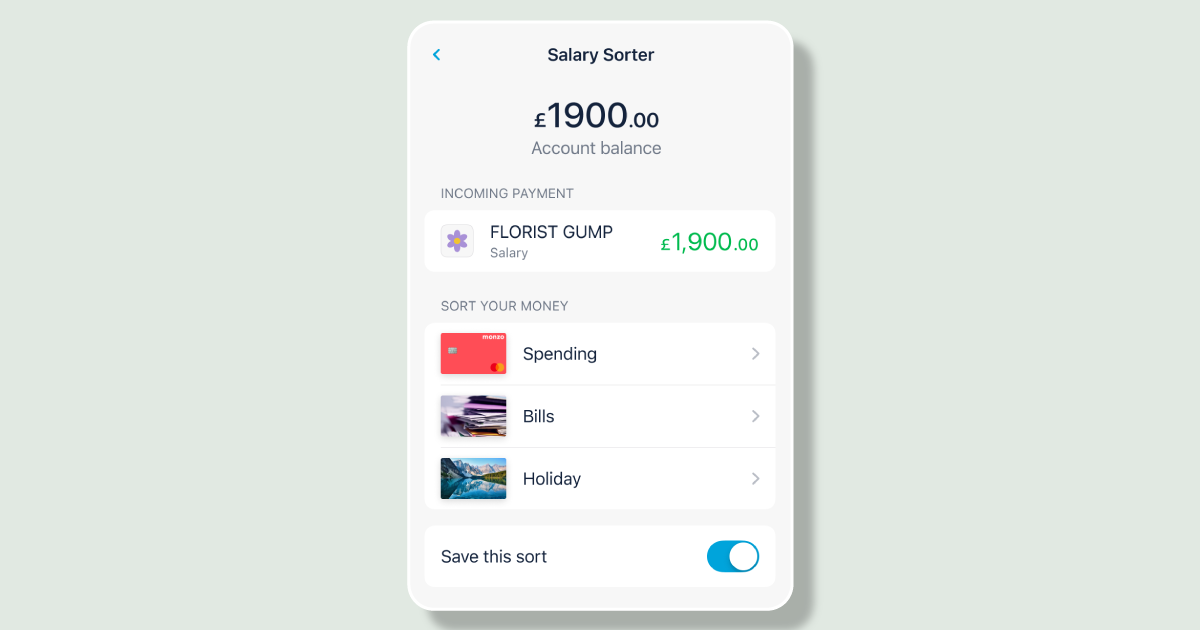

The best time for cash stuffing is pay day – once you’ve been paid, you sit down and sort your cash into various envelopes or a binder. If you get your salary paid into your Monzo account, you can organise your money the moment it arrives. The Salary Sorter is a quick and easy way to allocate your money into Pots – without actually having to count it – so you’re instantly prepared for the month ahead.

And the next time you’re paid from the same company, you’ll see an option to remember your Salary Sorter preferences – so you can sort your money into Pots automatically.

Save your (virtual) spare change

When you use cash, pretty soon you’re going to start racking up the spare change. So another classic saving tactic that’s becoming popular again is collecting it in a loose change jar.

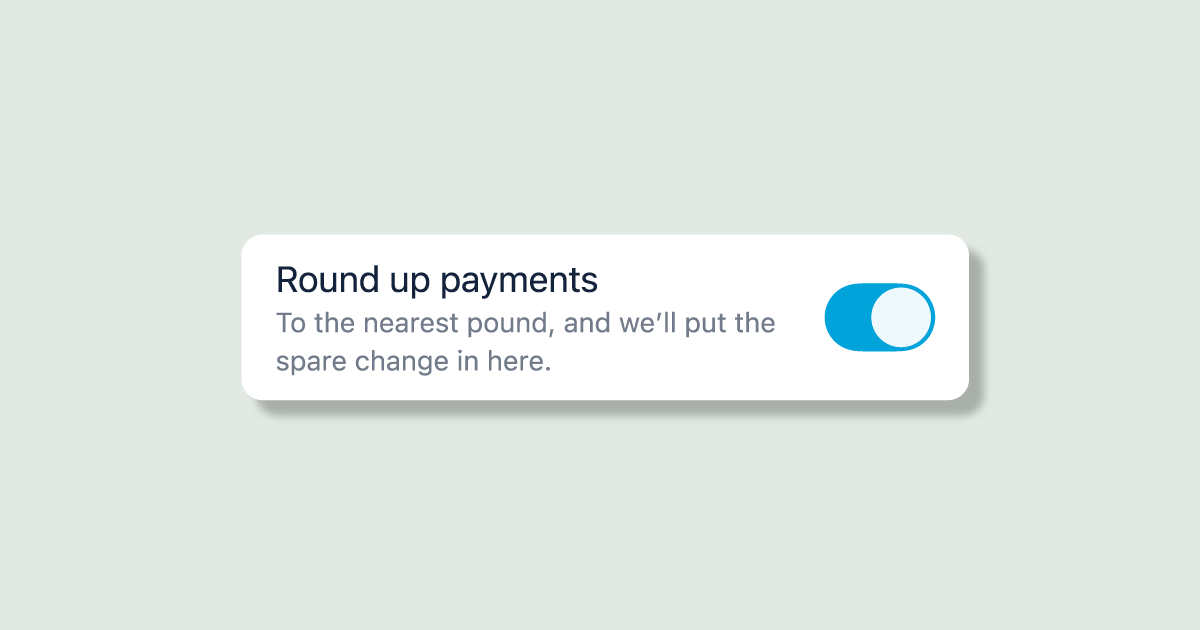

Monzo helps you do the same thing virtually. When you create a Pot, you can turn on roundups. This means that every time you spend, we’ll round up your purchase to the nearest pound and put the change in your Pot. For example, if you’re buying a snack for £2.79, we’ll put the extra 21p in your Pot.

You can choose to put your change in any Pot you have – so if you fancy extra money for a meal out, or want to boost your Christmas savings, you can reach your goals faster. And unlike a spare change jar, you’ll get instant access to your money without having to haul your coins to a bank first.

Try out these tactics with Monzo and see if they help with budgeting, saving and working towards your financial goals!