We’re all watching our money more closely right now. And we’ve heard from lots of you about the small changes you’re making with Monzo to feel more in control.

Whether that’s getting a little extra help with sticking to your budget or sharing costs more easily with pals (so you don’t have to awkwardly chase them to pay you back), there are simple steps you can take to stay on top of your money.

Over the next few weeks, we’re sharing these steps so you can see if they make a difference for you. And what’s more, you can do each one in minutes. Let’s take a look…

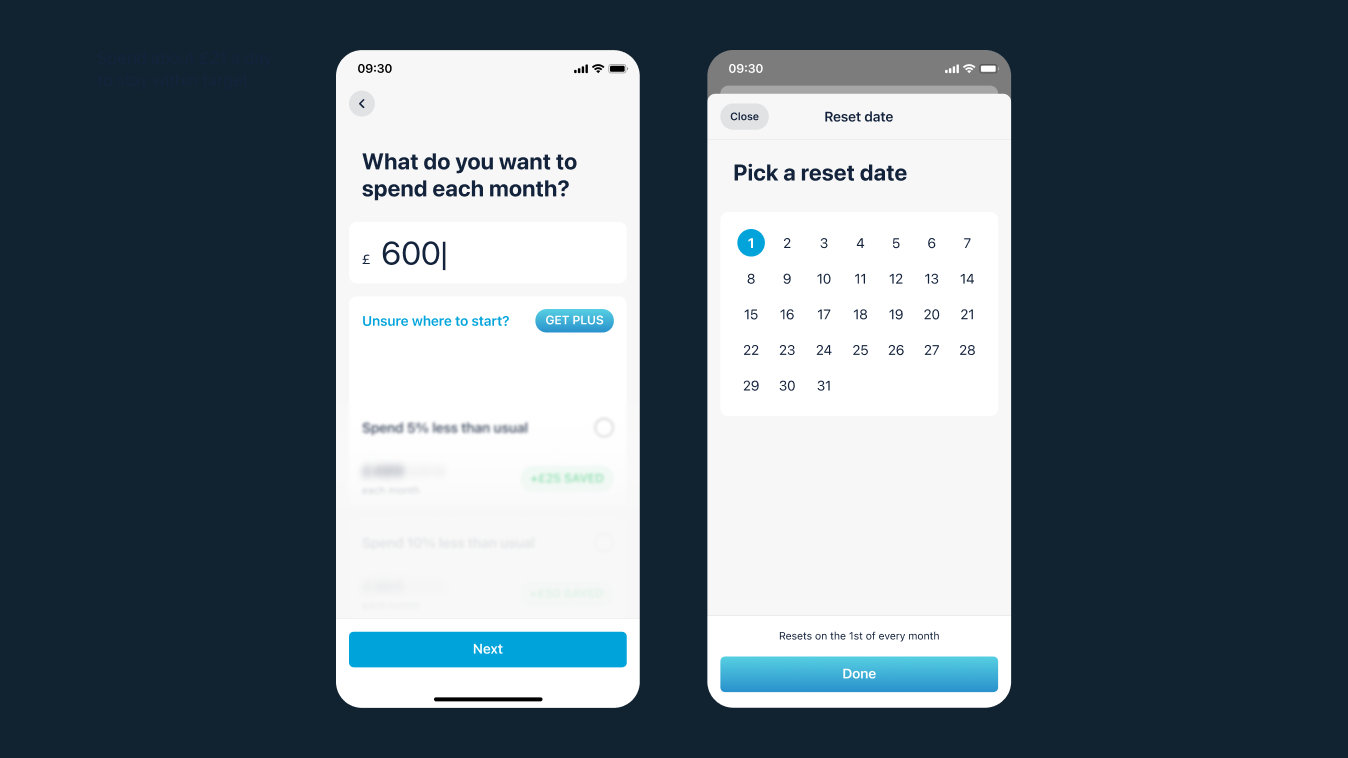

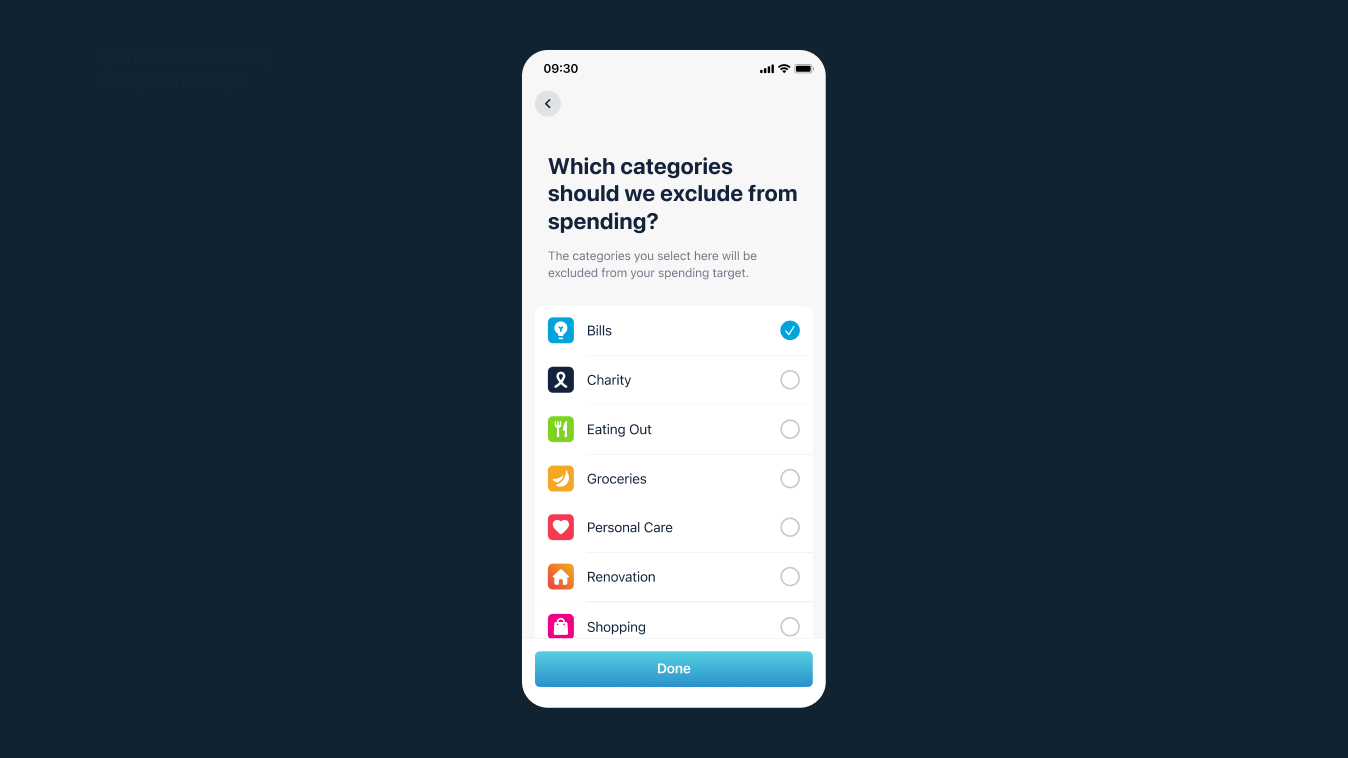

Set a monthly spending target

When you’re trying to liven up a gloomy February, you might be tempted to spend a bit more money. Setting a spending target in advance can help you stay on budget while still finding time to enjoy yourself.

And the extra money you save by sticking to your target can help you reach your savings goals faster – whether that’s a new bike or a sunny holiday. Remember sun?

We’ll help you hone on the areas you want to cut back on by giving you the option to exclude certain categories of spending. You might want to exclude rent or bills, for example, or other non-negotiable areas (like treats for your dog). You can also reset your spending target based on when you get paid – so you can keep hitting your target, month after month.

If you have Monzo Plus, we’ll also analyse your recent spending to help you decide on the spending target that’s right for you. So if you want to spend 5% or 10% less than last month, we’ll work it all out for you.

Monzo Plus is £5 per month • 3 month minimum • Must be aged 18+ • Ts&Cs apply

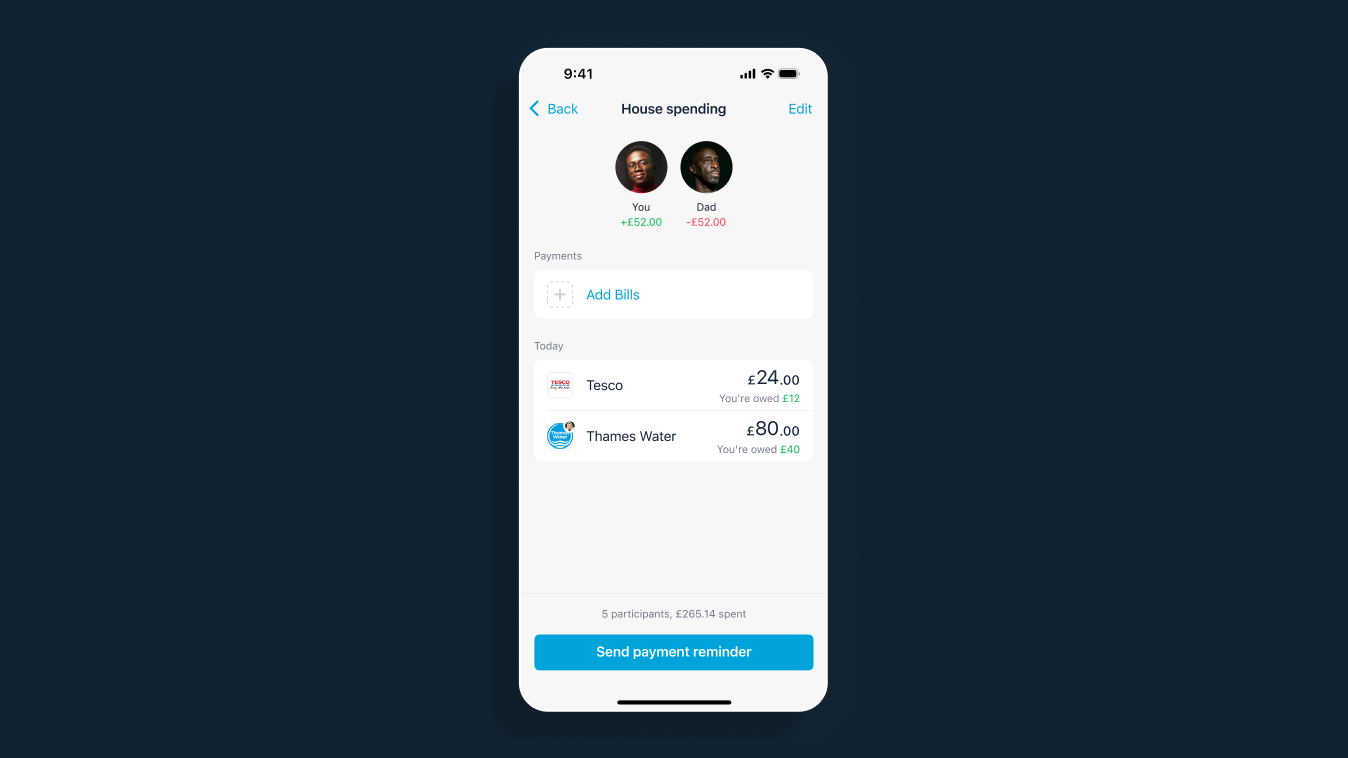

Split costs fairly and quickly

When you’re eating out with pals, it’s not always easy to decide on a place to go. And it can be even trickier to work out who owes what afterwards. Thankfully, with a Shared Tab, you can easily split ongoing costs in seconds.

From fun stuff like evenings out to the much less fun stuff like household bills, add any cost you need to split to your Shared Tab and we’ll take care of the maths. You can see who’s paid what and settle up in just a few taps.

You can also divvy up individual payments in your feed, thanks to our bill splitting feature. What’s more, you can do this with pals who aren’t on Monzo (yet) just by sending a quick link or using bluetooth if they’re nearby.

That way, you’re always on top of how much everyone owes. And you never have to awkwardly chase someone for money again.

Get paid a day early

Nothing beats payday, and that satisfying feeling when your money finally hits your account.

You wouldn’t think it could get any better. But if you get paid into your Monzo account, it just might. When you get your salary paid into Monzo, we’ll bring your payday forward by a whole day (as long as you’re paid by Bacs, which most people are). That means you’ll get your money a day early every month!

We’ll also take care of splitting your salary up into spending money, bills and savings – so you’re on top of your money instantly, without lifting a finger. Simply use the Salary Sorter to automatically divvy your money up into your different Pots. Then you’ll know exactly how much you have to spend on things like nights out, shopping and that fancy food delivery box for your dog 🐶

It’s easy to switch your salary to Monzo – we’ve even drafted a friendly little email that you can send to your employer to make it happen.

That’s all for now, folks! But stay tuned for more small (and powerful) changes you can make with your money coming soon.

🌱Small Change is a new series of ideas we’re sharing to help you stay on top of your money and make it go a little further. We'll share practical steps you can take with Monzo in minutes, as well as stories from folks who’ve found what’s worked for them 🌱

Check out our other guides on managing your money, and reaching your savings goals faster.