Technology

A Day in the Life of a Technical Programme Manager at Monzo

The Technical Programme Manager (TPM for short) role is hugely varied. I want to take you on a journey through a typical day in my life as a Technical Programme Manager here at Monzo.

Protecting our platform from spikes in usage by reducing load from the Monzo app

This blog explores how we’ve made our platform more resilient to spikes in app opens. We can now reduce load on our platform before we get overwhelmed so you can still access and use critical parts of the app, and your card continues to work.

The SKAdNetwork Puzzle: Using Data to Solve for Effective Performance Marketing

This blog talks through how Monzo uses Data Science and Analytics Engineering to measure the value of paid marketing as Apple’s SKAdNetwork changes the mobile advertising landscape, which helps to inform our wider strategies of sustainable growth

Tech leading as a mobile engineer at Monzo

Mark has written about his experience and growth as a tech lead at Monzo over the last 18 months - from creeping doubts to using his mobile engineer’s perspective to shape the role to his strengths

My path from Intern to Staff Engineer at Monzo

This blog discusses our Staff Engineer, Jacob, and his experience starting at Monzo as an intern in Engineering, and how he has developed into a Staff Engineer role.

How we launch new products at Monzo

From staff testing to Monzo Labs, learn about the different ways Monzo launches new products and features - and how we don't always get it right!

Five lessons from my first year at Monzo

Tarah Srethwatanakul is a Lead Researcher at Monzo. In this blog post, she shares lessons from her first year at the company.

How we do product management in the financial difficulties space

In Financial Health, we’re responsible for making sure we build the right tools and experiences to help our customers through thick and thin if they experience financial difficulties, while also helping Monzo grow its Borrowing products.

Finding your fit in a new product team

This is my experience of how I searched for and found my fit as a Product Designer in my first few months at Monzo, but I believe this applies to any role joining a new product team.

Sensitivity analysis

This blog explains sensitivity analysis, which is a useful data science technique for assessing the impact of different variables on an outcome metric.

How we manage technology risk at Monzo

In this post, three Monzonauts explain how they work together with each other and other disciplines to manage risk in a fast-moving tech-focused banking environment.

Speeding up our balance read time: The planning phase

The ledger is where we keep track of all customer money movements coming in and out of customers’ accounts. We started a project to speed up the ledger balance read time. In this post we’ll cover the planning and experiments we ran.

What we learned from 43 experiments in 12 months

This blog shares some of the learnings we've had from our experiments in customer help and support over the last year

Sweating the Small Stuff: What do app screens and pedestrian-crossings have in common?

This blog talks about why app screens are like pedestrian crossings, or more specifically, how some subtle tweaks to a user-interface in Monzo's sign-up process has had a surprisingly large impact!

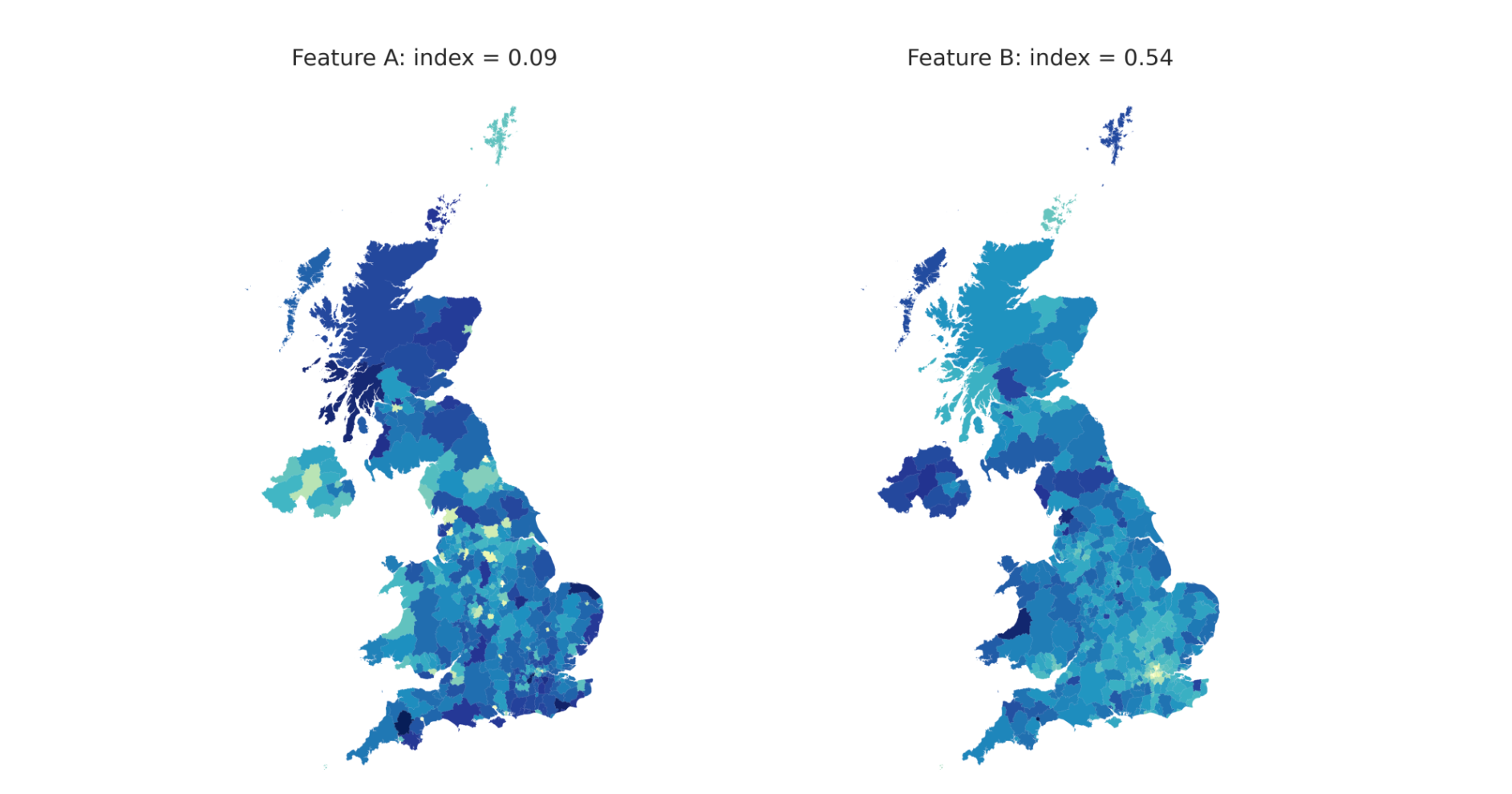

Designing a regional experiment to measure incrementality

This blog post covers the approach for how we designed a regional experiment to measure the incremental impact of our referral scheme on new customer growth.